Track retainage in QuickBooks Online

Retainage or holdbacks is the sum withheld by the customer on progress payments and is later released to the contractor per the terms of the contract. In regards to Sage Construction Management, retainage is applicable on both prime invoice (AR) and sub invoice (AP) features.

When exporting progress invoices to QuickBooks Online, the Sync Wizard can either include retainage or not depending on the Sync Preferences. If it will be tracked in QuickBooks Online, follow the setup guidelines below.

| Type of record | Name | Type |

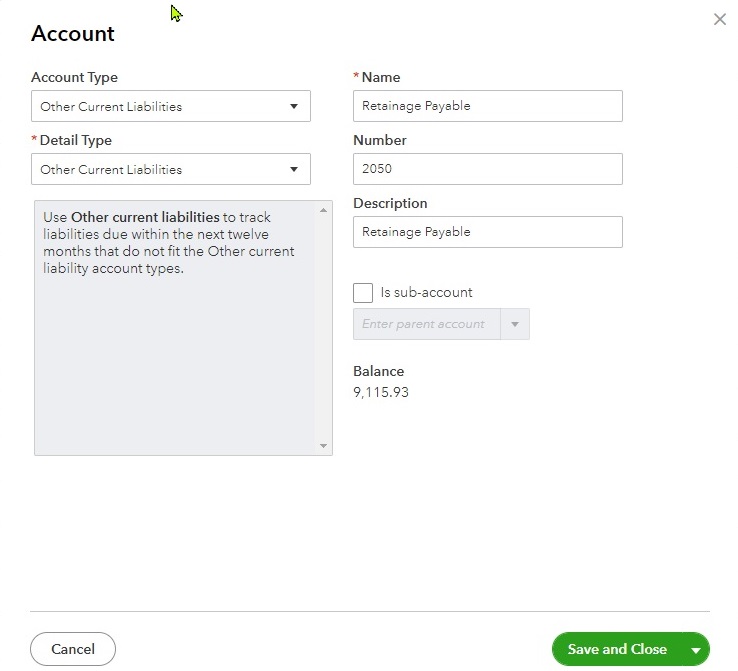

| Chart of Account | Retentions Payable | Non Tax Related | Other Current Liability |

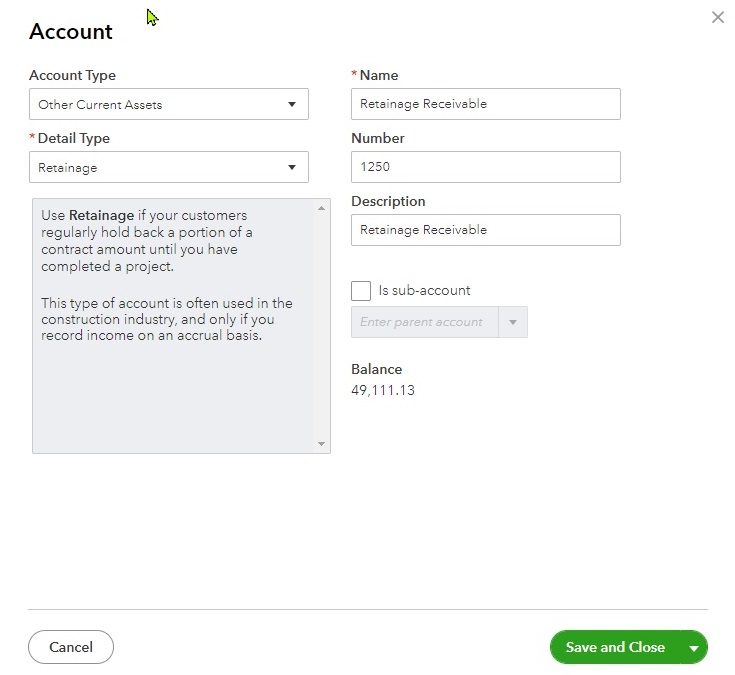

| Chart of Account | Retentions Receivable | Non Tax Related | Other Current Asset |

| Service Item | Retention or Holdbacks |

AP Chart of Account = Retentions Payable

AR Chart of Account = Retentions Receivable |

The example below shows how retainage is handled depending on the Sync Preferences.

Sage Construction Management invoice example: 10% retainage (applies to prime invoices or sub invoices)

| Item description | Inv. total | Retainage | Total less retainage | Job cost code |

| Concrete | $50,000 | $5,000 | $45,000 | 03000 |

| Masonry | $40,000 | $4,000 | $36,000 | 04000 |

| Total | $90,000 | $9,000 | $81,000 |

Invoice exported to QuickBooks Online without retainage shown

| Item description | Inv. total | Service item reference |

| Concrete | $45,000 | 03000 |

| Masonry | $36,000 | 04000 |

| Total | $81,000 |

Invoice exported to QuickBooks Online with retainage shown

| Item description | Inv. total | Service item reference |

| Concrete | $50,000 | 03000 |

| Masonry | $40,000 | 04000 |

| Retention | -$9,000 | Retention |

| Total | $81,000 |