Tax codes

Set up tax code mapping to send the correct Sage 300 Construction and Real Estate tax codes on transaction lines from Sage Construction Management to Sage 300 Construction and Real Estate.

This help topic describes how you can map your Sage Construction Management tax codes to Sage 300 Construction and Real Estate tax groups.

-

-

Before setting up the tax code mapping, items must have been created for each tax rate in Sage 300 Construction and Real Estate.

-

Be sure to create tax codes in Sage 300 Construction and Real Estate for all of the tax scenarios that you need.

-

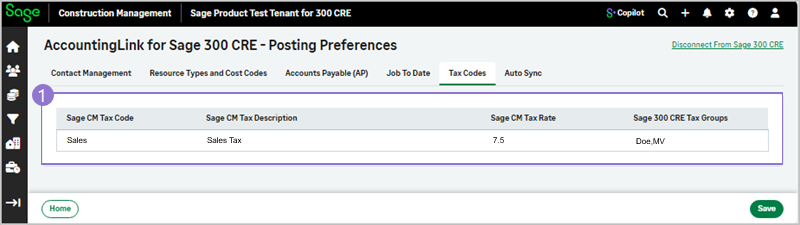

Select AccountingLink > Posting preferences > Tax codes.

You'll see a list of your Sage Construction Management tax codes, along with columns for the different cost types.

-

For the first tax code, select the applicable Sage 300 Construction and Real Estate tax group.

-

Do this for the remaining tax codes.

-

Select Save.

The Save option is grayed out if any required fields are not filled out. Select the Missing Required Fields link to view the fields that must be filled out in each tab before saving.After you've set up the mapping, this is what happens:

-

Line items in Sage Construction Management must be assigned with the correct tax code.

-

When the transaction is sent to Sage 300 Construction and Real Estate, the tax codes entered on the lines are matched to the Sage 300 Construction and Real Estate items that they're mapped to.

-