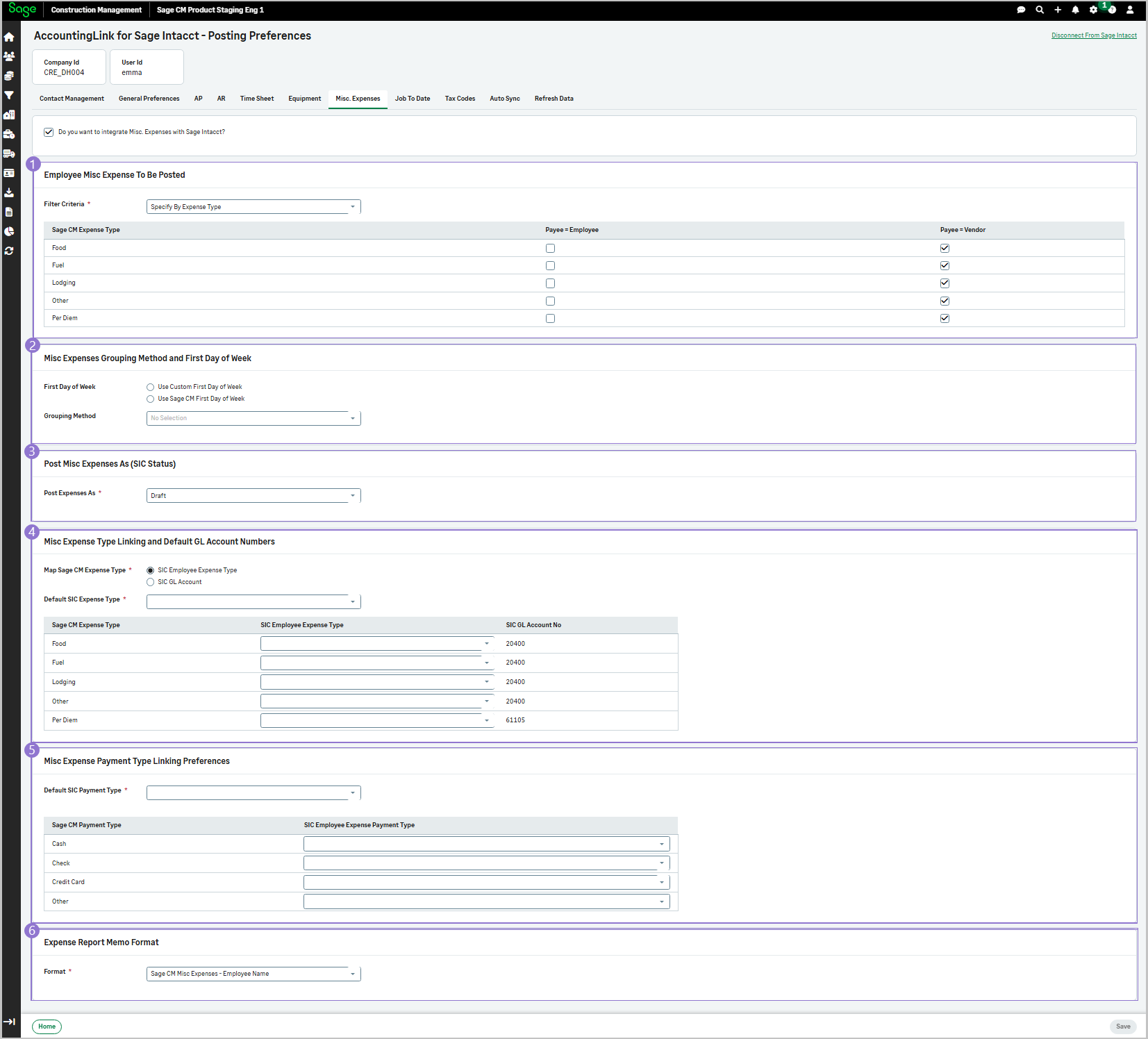

Misc. Expenses tab

You can now integrate miscellaneous expenses with Sage Intacct. Sage Construction Management provides options to specify whether the posting rules are selected according to the payment type, e.g., cash, Mastercard, etc., or according to the expense type, e.g., food, fuel, etc., for the employee and the vendor.

Open the Misc Expenses tab and select Do you want to integrate Misc. Expenses with Sage Intacct?.

Set the posting preferences as needed and select Save.

-

Select the posting rules from the Filter Criteria dropdown:

-

Post all approved expenses: Post all approved expenses and select Payee - Employee or Payee - Vendor, or both.

-

Specify by Expense Type: Specify the expenses by expense type, e.g., select Food, Fuel, Lodging, Per Diem, Other, per Payee - Employee or Payee - Vendor, or both.

-

Specify by Payment Type: Specify the expenses by payment type, e.g., select Cash, Check, Credit Card, or Other, per Payee - Employee or Payee - Vendor, or both.

-

-

Select one of the following options:

-

Select Use Custom First Day of Week and set the First Day of Week, e.g., Monday, or Sunday, etc.

-

Select Use Sage CM First Day of Week and set the first day of the week to be the same as the one used in Sage Intacct.

-

Select the Grouping Method, to select how to group miscellaneous expenses per report section from the dropdown, e.g.:

-

By Employee & Week, or

-

By Employee, Week & Project

-

-

-

Select one of the following options for the SIC status of the expenses to be posted:

- Draft

- Submitted

-

-

Select how to Map Sage CM Expense Type:

-

SIC Employee Expense Type: Select this option to map the expense type, such as Food, Fuel, Lodging, Per Diem, or Other, to each SIC GL Account No.

-

SIC GL Account: Select this option to map the SIC GL Account No to each expense type.

-

-

Select the Default GL Account from the dropdown.

-

-

-

Select the Default SIC Payment Type from the dropdown.

-

Map each Sage CM Payment Type with the corresponding SIC Employee Expense Payment Type.

-

-

Select the report format from the dropdown:

-

Sage CM Misc Expenses - Employee Name

-

Sage CM Misc Expenses - Employee Name - Week of + First Day of Week

-