Tax calculation options for prime invoices and sub invoices

This release introduces new options that allow you to apply taxes either on the net or gross amount for prime invoices and sub invoices when using the AccountingLink for Sage Intacct.

Details

You can now choose how taxes are calculated for prime invoices and sub invoices:

-

Tax on Net Amount (Less Retainage): Select this option to calculate tax on retainage release (invoice line amount net of retainage) used for VAT/GST enabled transactions. Taxes are calculated on all invoices, including released/billed retainage.

Taxes should be based on the total amount after retainage is removed.

-

Tax on Gross Amount: Select this option to calculate tax on retainage held (gross invoice line amount) for all tax solutions.

Taxes are calculated based on the total amount before retainage is deducted.

Taxes will be zero (0) for any released retainage.

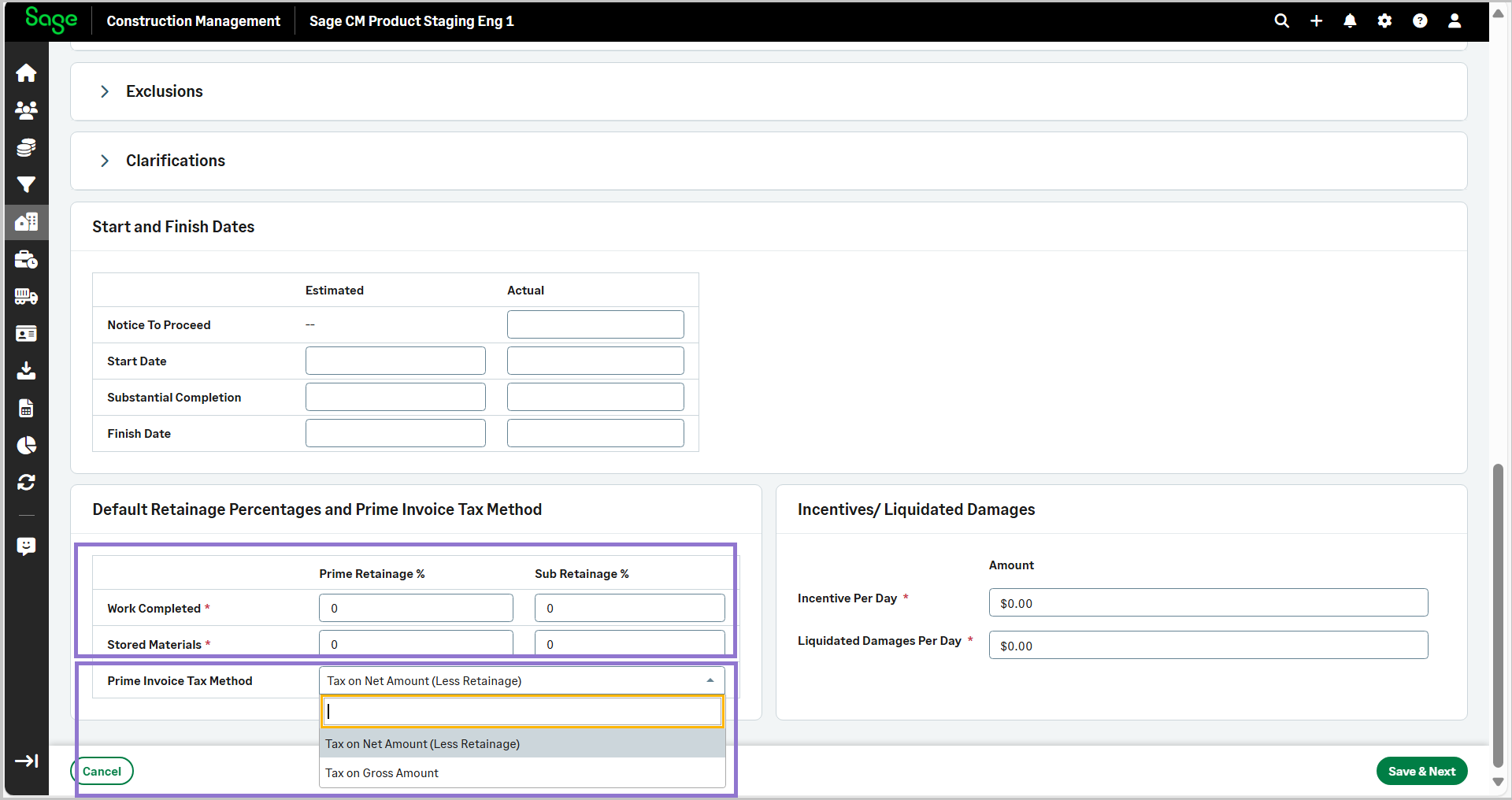

You can set the default prime retainage and sub retainage percentages for the work completed and the stored materials.

How it works

-

Go to Projects, open a project, and select Prime Invoices or Sub Invoices from the Project Menu.

-

From the Actions menu, select Add Manually.

-

Enter the prime retainage and sub retainage percentages for the work completed and the stored materials.

-

Select Tax on Net Amount (Less Retainage) or Tax on Gross Amount.

-

Select Save & Next.