QuickBooks data setup suggestions

Below are some general guidelines on how to setup QuickBooks for an architectural, engineering or construction firm with the intention of integrating it with Sage Construction Management.

Customers, vendors, and employees

Import vendors and employees

You can import active vendors and employees from QuickBooks using AccountingLink, so it's recommended best practice to review each list in regards to their status. For example, if a vendor is no longer used, then it should be marked as inactive in QuickBooks before using AccountingLink to import them in Sage Construction Management.

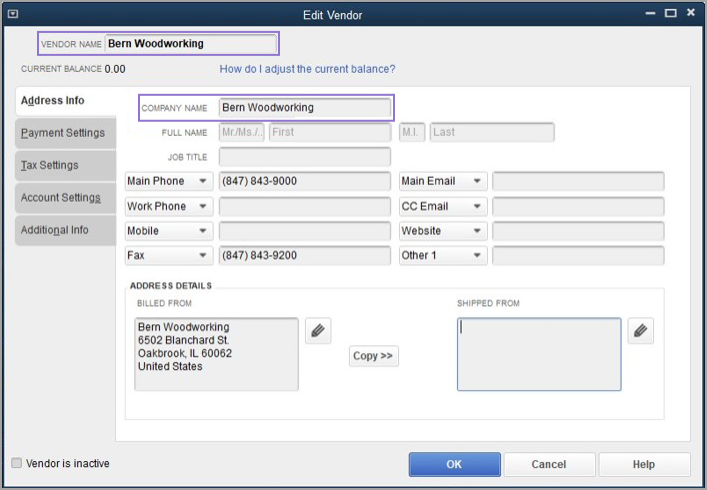

Auto link customers and vendors with Sage Construction Management companies

When you automatically link records between Sage Construction Management and QuickBooks, the Company Name field in QuickBooks is used for matching. The customer or vendor name will not be used.

Sage Construction Management and QuickBooks awarded job setup

Sage Construction Management does not offer a Customer:Job import option and existing Jobs must be completed in QuickBooks. However, newly awarded projects must be set up in Sage Construction Management and then exported to QuickBooks. The client referenced in the prime contract is the customer and the combination of the project and prime contract numbers is the job number in QuickBooks.

Recommended chart of accounts

| Type of account | Account description | Comment |

| Asset | Checking Account | |

| Accounts Receivable | ||

| Retentions/Holdback Receivable | This account must be created if retainage or holdbacks for prime contract invoices will be tracked in the accounting system. | |

| Liability | Accounts Payable | |

| Retentions/Holdback Payable | This account must be created if retainage or holdbacks for sub invoices will be tracked in the accounting system. | |

| Credit Card Payable | There might be multiple credit card payable accounts, one for each card type, such as Visa, Mastercard, AMEX, or Home Depot. | |

| Sales Tax Payable | There might be multiple sales tax payable accounts, such as one for each region in Canada (GST, PST, HST) or for each sales tax authority in the United States. | |

| Income | Construction Income | Cost code service items will reference this account when exporting prime contract invoices. |

| Expense | Construction Expense | Cost code service items will reference this account when exporting bills, sub invoices, and employee miscellaneous expenses. Alternatively, you can use separate expense accounts for each resource type, such as materials, labor, equipment, sub, and other. |

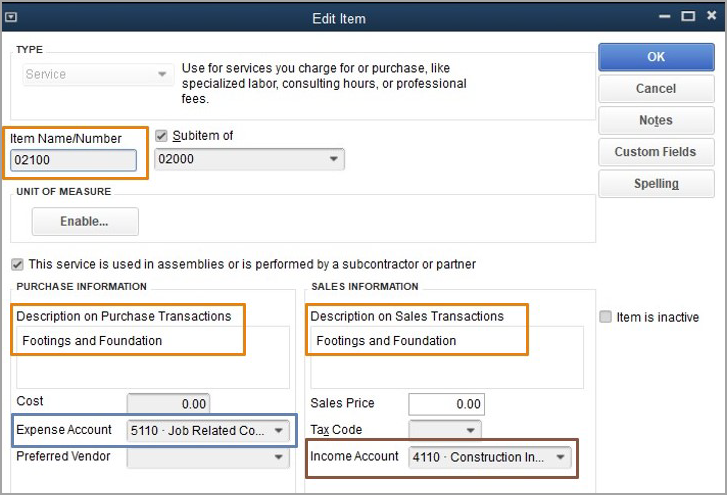

Service items for cost codes

The core principle of job costing is to maintain a master list of cost codes to consistently categorize work. These standard cost codes will be used across estimating, project management, and accounting teams to ensure smooth and accurate information flow between departments.

To support integration between Sage Construction Management and QuickBooks, enter each cost code as a service item, matching both the code and description in both systems. These service items must reference the same expense/COGs and income GL accounts. When exporting project financials from Sage Construction Management to QuickBooks, job cost code references are automatically replaced with their corresponding service items, so consistent naming and account mapping are essential.

Finally, configure the AccountingLink Sync Preferences, to control how these items are mapped and synchronized during the export process.

Import industry standard cost codes for service items

Learn more about importing CSI or NAHB codes into QuickBooks Desktop here.

Track expenses by cost code and resource type

Service items in QuickBooks must not have a resource identifier, such as material, labor, equipment, sub, or other. Instead, resources must be set up as classes in QuickBooks.

For example:

-

Recommended setup:

-

Service items:

-

02000 Sitework

-

03000 Concrete

-

-

Classes:

-

Materials

-

Labor

-

Equipment

-

Sub

-

Other

-

-

-

Not recommended setup:

-

Service items:

-

02000 Sitework

- 02000-M Sitework Materials

- 02000-L Sitework Labor

- 02000-E Sitework Equipment

- 02000-S Sitework Sub

-

03000 Concrete

- 03000-M Concrete Materials

- 03000-L Concrete Labor

- 03000-E Concrete Equipment

- 03000-S Concrete Sub

-

-

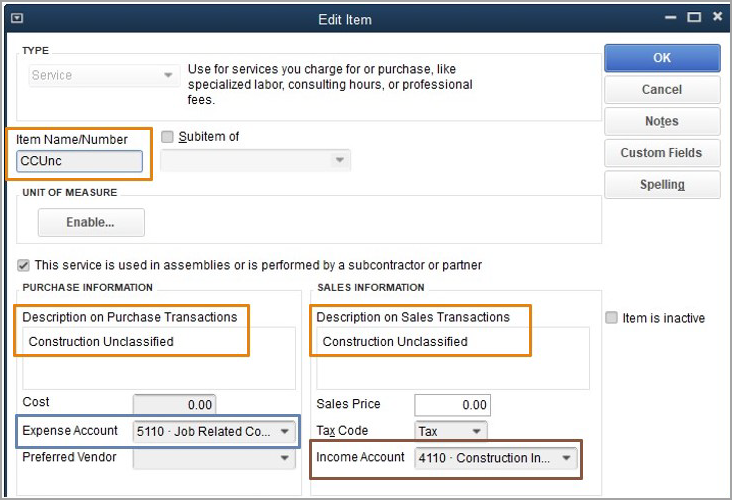

Service item for missing cost code in QuickBooks

If Sage Construction Management and QuickBooks have a master cost code structure, the AccountingLink must be set up with a backup item to handle cases where a Sage Construction Management project cost code does not exist in the accounting system. The unclassified item will reference the same expense/COGs and income GL chart of accounts as standard cost code service items.

The construction unclassified or backup item must be set as the default item for AP, AR, and time tracking in the Sync Preferences.

Service item for exporting bills, sub invoices, and miscellaneous expenses that have tax (US only)

Because the QuickBooks Bills feature does not support tax codes, Sage Construction Management adds a separate line item to represent tax, ensuring the total amount matches in both systems.

Item name: AP Sales Tax: AP Sales Tax

AP account reference: Construction Expense

AR account reference: Not Applicable

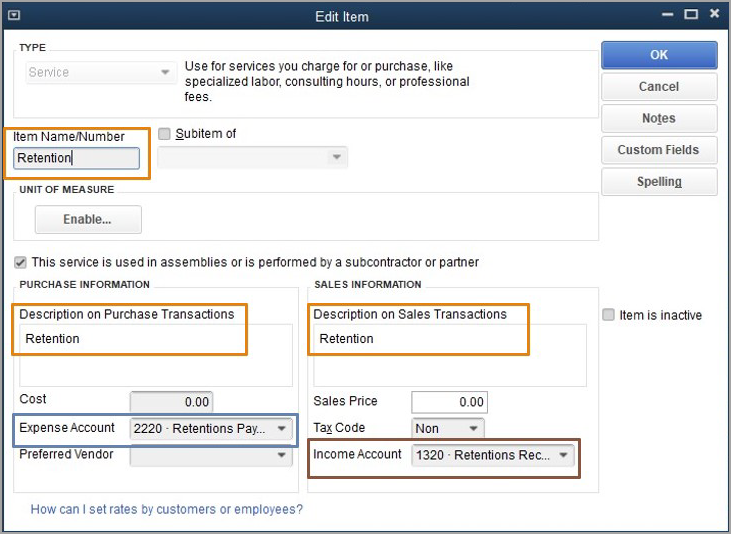

Service item to track retainage

This option is applicable if retainage or holdbacks for sub invoices and prime contract invoices will be tracked in QuickBooks.

Learn more about tracking retainage in QuickBooks Desktop here.

Classes

Classes are supported in AccountingLink for QuickBooks Desktop and can be used to categorize transaction details. If this feature is enabled in QuickBooks Desktop and used alongside Sage Construction Management, class records should either represent a resource, such as materials, labor, equipment, subcontractors, or other, or align with a specific Sage Construction Management project classification system.

You can find the classification settings in Sage Construction Management in Settings > Feature Settings > Lead / Project.