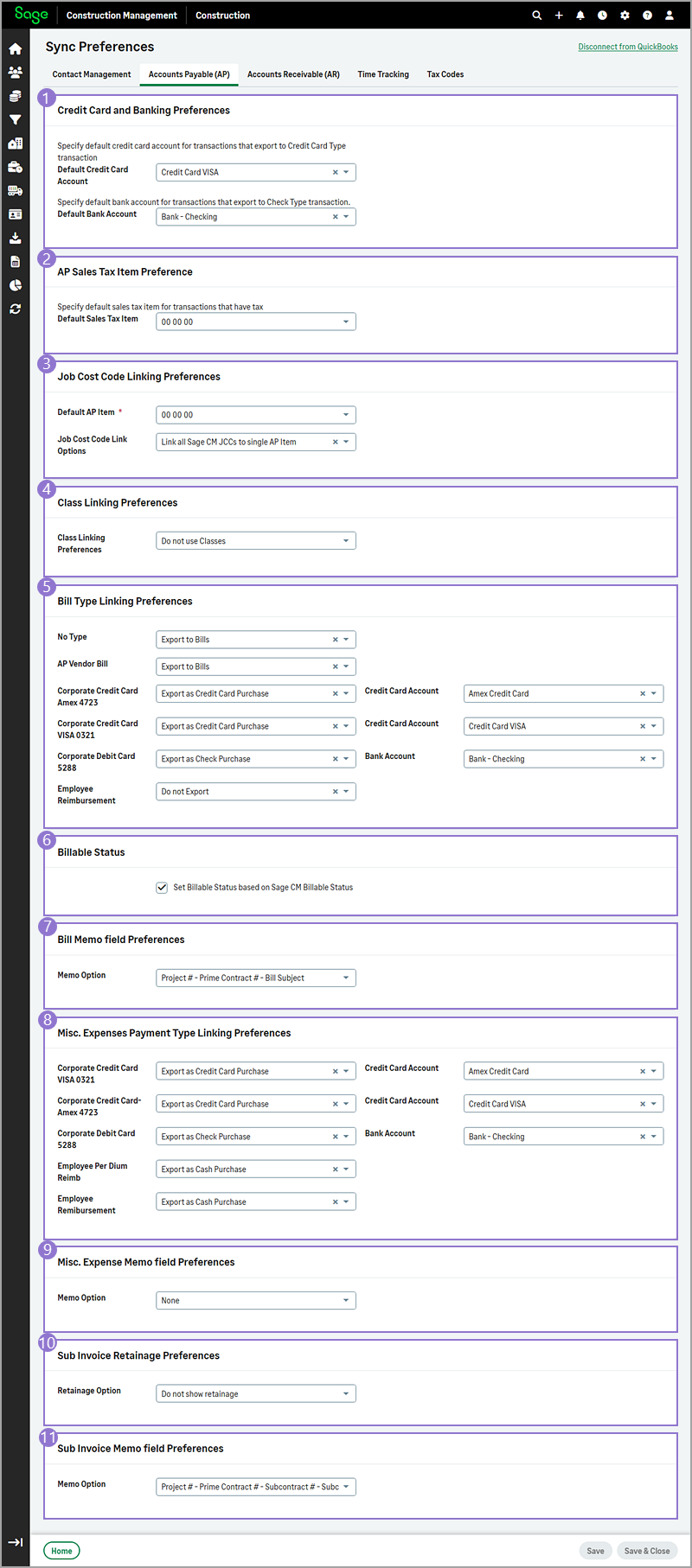

Accounts Payable (AP) sync preferences

-

Options Description Default Credit Card Account Sage Construction Management Bills and Misc. Expenses can be exported to QuickBooks Online's credit card feature. The Default Credit Card setting will be used when no card has been specified. Default Bank (Checking) Account Similar to the Default Credit Card Account, Sage Construction Management Bills and Misc. Expenses can be exported to QuickBooks Online's Check feature. The Default Checking Account will be used when no other account has been specified. -

The Default Sales Tax Item is used to track sales tax separately from the purchase cost, while ensuring that the tax amount is not posted to Sales Tax Payable. It is intentionally directed to the cost of goods (COGS) General Ledger account in your accounting application. This approach is useful when sales tax is treated as part of the expense rather than a liability, allowing for more accurate cost tracking in specific accounting workflows.

-

Default AP service item

Accounts payable transactions in Sage Construction Management, such as bills, sub invoices, and miscellaneous expenses, must reference a job cost code whereas expense entries in QuickBooks Online require a service item. Thus, to export expenses from Sage Construction Management to QuickBooks Online rules need to be established on how the job cost code must be replaced with the appropriate service item. The Default AP Item serves as a fallback during auto-linking when matching by cost code or description, or when replacing cost codes with a single service item.

It's recommended to set the Default AP Item to the unclassified item, for example, 00CCUnc.

Job cost code linking options

Options Description Link all Sage Construction Management JCCs to a single AP Item All Sage Construction Management bill, sub invoice, and miscellaneous expense items will reference the default AP service item referenced above. Link AP Item based on resource type (M, L, E, S and O) In Sage Construction Management there are five built-in resources: Material (M), Labor (L), Equipment (E), Subcontractor (S), and Other (O). When Sage Construction Management sub invoices are exported to QuickBooks Online, the Subcontractor (S) reference will be used. When exporting Sage Construction Management bills and miscellaneous expenses, the mapping will be dependent on the item's resource reference. Auto Link AP Item based on the Project Number (exact match only) If service items in QuickBooks Online reflect projects, then Sage Construction Management job cost codes can be linked automatically using the project number as the criteria. For example, if there are 20 projects in Sage Construction Management then there will be the same number of service items. The service item's name will be the project number not title. In cases where there's no match upon export, the default AP service item referenced above will be used. Link AP Items to a specific Project Classification Project classifications can be set up in Sage Construction Management to categorize leads and projects. For example, a classification system titled Project Type could be created with options such as Custom Home, Apartment, School, Lab, or Retail Facility. Each lead or project will then reference one of these options. If service items in QuickBooks are set up in a similar manner, then this option must be used to set the appropriate item. Auto Link AP Item based on the Job Cost Code (exact match only) If services items in QuickBooks Online reflect cost codes, then Sage Construction Management job cost codes can be linked automatically using the code/name as the criteria. Specifically: - The job cost code is matched first.

- If the job cost code is not found, AccountingLink looks at the internal division code to find a match.

- If the internal division code is not found, the AccountingLink will use the default AP item.

This is the recommended setting.

Auto Link AP Item based on the Job Cost Code Description (exact match only) Similar to the option above but the cost code description will be used as the criteria. Specifically: - The job cost code description is matched first.

- If the job cost code description is not found, AccountingLink looks at the internal division code description to find a match.

- If the internal division code description is not found, the AccountingLink will use the default AP item.

-

Options Description Do not use classes No classes are used. This is the default option. Set Class based on Resource Type (M, L, E, S, O) In Sage Construction Management there are five built-in resources: Material (M), Labor (L), Equipment (E), Subcontractor (S), and Other (O). When Sage Construction Management sub invoices are exported to QuickBooks Online, the Subcontractor (S) reference will be used. When exporting Sage Construction Management bills and miscellaneous expenses, the mapping will be dependent on the item's resource reference. Set Class based on Project Classifications Project classifications can be set up in Sage Construction Management to categorize leads and projects. For example, a classification system titled Project Type could be created with options such as Custom Home, Apartment, School, Lab, or Retail Facility. Each lead or project will then reference one of these options. If service items in QuickBooks are set up in a similar manner, then this option will be used to set the appropriate item. Set Class based on Internal Job Cost Grouping Division If services items in QuickBooks Online reflect cost code divisions, then Sage Construction Management job cost code divisions can be linked automatically using the code/name as the criteria. Set Class based on Internal Job Cost Grouping Major If services items in QuickBooks Online reflect cost code majors, then Sage Construction Management job cost code majors can be linked automatically using the code/name as the criteria. Set Class based on Internal Job Cost Grouping Minor If services items in QuickBooks Online reflect cost code minors, then Sage Construction Management job cost code minors can be linked automatically using the code/name as the criteria. In QuickBooks Online, a class is used only for reporting purposes and does not affect how costs are posted to the General Ledger. Only service items in QuickBooks Online determine how costs are recorded in the ledger. Using classes is optional and has no impact on reporting within Sage Construction Management. -

Sage Construction Management bills can be categorized using types that are used for grouping and filtering purposes. From an AccountingLink perspective, these types can also determine how bills must be exported to QuickBooks Online. You have the following options for each bill type:

- Do not export

- Export to Bills

- Export as Credit Card Purchase

You have the option to set the default credit card.

- Export as Check Purchase

You have the option to set the default bank/checking account.

- Export as Cash Purchase

How can bills be exported as a cash purchase?In certain workflows, bills might be exported to QuickBooks Online as cash purchases. For this scenario, you need to set up a dedicated account in QuickBooks Online for cash on hand. This account must then be selected when configuring the export option to ensure transactions are recorded accurately.

How do bills with negative totals appear in QuickBooks Online?Bills that have a negative (-) total will appear as a credit in QuickBooks Online.

Where can bill types be set up in Sage Construction Management?Admins can set up bill types in Settings (

) > Feature Settings > Procurement.

) > Feature Settings > Procurement. -

If the Set Billable Status based on Sage CM Billable Status option is selected, Sage Construction Management includes the billable status when posting bills to QuickBooks Online.

-

The following options are available for formatting the Memo field when exporting Sage Construction Management bills to QuickBooks Online:

- Project # - Bill Subject

- Project # - Prime Contract # - Bill Subject

- Project # - Project Title - Bill Subject

- Project # - Project Title - Prime Contract # - Prime Contract Subject - Bill Subject

- Project Title - Prime Contract Subject - Bill Subject

-

Sage Construction Management miscellaneous expenses have a payment type reference that can be used for grouping and filtering purposes. From an AccountingLink perspective, these payment types can also determine how these transactions must be exported to QuickBooks Online. You have the following options for each payment type:

- Do not export

- Export as Credit Card Purchase

You have the option to set the default credit card.

- Export as Check Purchase

You have the option to set the default bank/checking account.

- Export as Cash Purchase

How do miscellaneous expenses with negative totals appear in QuickBooks Online?Miscellaneous expenses that have a negative (-) total will appear as a credit in QuickBooks Online.

Where can miscellaneous expense payment types be set up in Sage Construction Management?Admins can set up miscellaneous expense payment types in Settings (

) > Feature Settings > Time & Expenses.

) > Feature Settings > Time & Expenses. -

The following options are available for formatting the Memo field when exporting Sage Construction Management miscellaneous expenses to QuickBooks Online:

- Project #

- Project # - Prime Contract #

- Project # - Project Title

- Project # - Project Title - Prime Contract # - Prime Contract Subject

- Project Title - Prime Contract Subject

-

The following export options are available for subcontract invoice retainage:

- Do not show retainage

- Show retainage in QuickBooks

If subcontract invoice retainage will be tracked in QuickBooks Online, make sure to reference the default and billed retainage items. Typically, the item referenced in both fields is the same.

-

The following options are available for formatting the Memo field when exporting Sage Construction Management subcontract invoices to QuickBooks Online:

- Project # - Subcontract # - Subcontract Subject

- Project # - Prime Contract # - Subcontract # - Subcontract Subject

- Project # - Project Title - Subcontract # - Subcontract Subject

- Project # - Project Title - Prime Contract # - Prime Contract Subcontract - Subcontract # - Subcontract Subject

- Project Title - Prime Contract Subcontract - Subcontract # - Subcontract Subject