Set up tax code mapping for Sage Intacct

Set up tax code mapping to send the correct Intacct tax item on transaction lines from Sage Construction Management to Sage Intacct. The item on the transaction line controls which tax rates are applied in Intacct.

This article describes how to map your Sage Construction Management tax codes to items that you have created in Intacct specifically for this purpose.

After you've set up the mapping, this is what happens:

-

Line items in Sage Construction Management must have the correct tax code assigned.

-

When the transaction is sent to Intacct, the tax codes entered on the lines are matched to the Intacct items that they're mapped to.

-

The Intacct item that is mapped to the Sage Construction Management tax code is saved to the line items on each transaction, which dictates which tax rate is applied to each line in Intacct.

Be sure that the correct Sage Construction Management tax codes are added to the transaction lines before the transaction is sent to Intacct.

For more information, see Set default tax codes on job cost codes table.

The type of transaction determines which mapped item is used for the line item in the transaction.

-

Line items on prime invoices use the item selected in the Accounts Receivable column.

-

The item selected in the materials, labor, equipment, subcontract, and other columns are used for the following transactions:

-

Purchasing invoices

-

Non-commitment vendor invoices

-

Subinvoices

-

Before setting up the tax code mapping, create an item for each tax rate in Intacct.

This tax rate may differ on Accounts Receivable lines versus Accounts Payable lines. The tax rate for Accounts Payable lines may differ depending on the cost type:

-

Labor (L)

-

Materials (M)

-

Equipment (E)

-

Subcontract (S)

-

Other (O)

Be sure to create items in Intacct for all of the tax scenarios that you need.

For information on creating items in Intacct, see one of the following articles, depending on whether you use advanced workflows.

Important: After creating the items for each tax code in Sage Intacct, you need to run the Refresh Data process in Sage Construction Management.

-

-

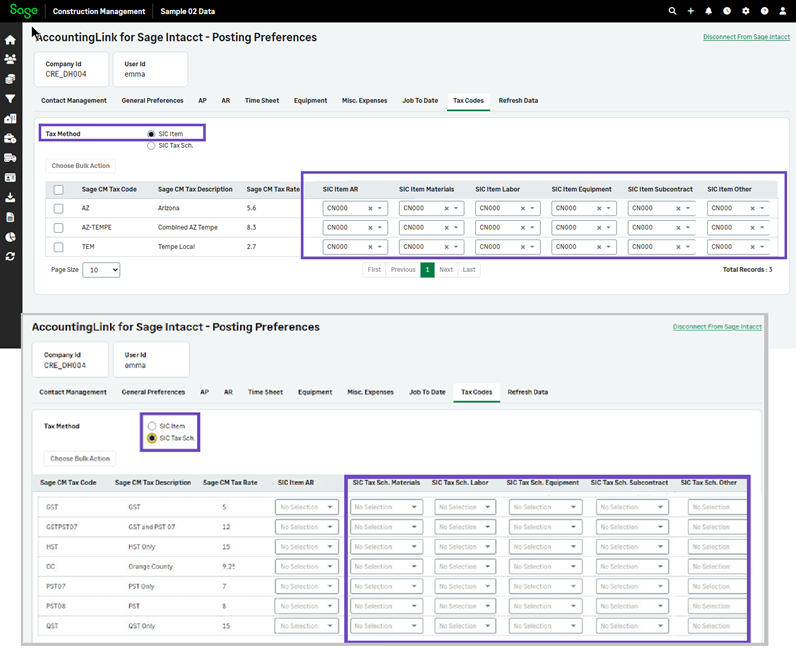

Select Accounting Link > Posting Preferences > Tax Codes.

You'll see a list of your Sage Construction Management tax codes, along with columns for the different cost types.

-

Select SIC Item.

- For each tax code, select the applicable Sage Intacct item from the dropdown list.

-

Select Save.

-

-

Map SIC tax schedules

-

Select Accounting Link > Posting Preferences > Tax Codes.

You'll see a list of your Sage Construction Management tax codes, along with columns for the different cost types.

-

Select SIC Tax Schedules.

- For each tax code, select the applicable Sage Intacct tax schedule from the dropdown list.

-

Select Save.

-

-

Enter a tax code in the Search field to find a tax code.

The Choose Bulk Action option enables you to do the following:

-

Clear all.

-

Copy Accounts Payable tax schedules to Accounts Receivable, or the opposite.

-

Copy Accounts Payable Material tax schedule to Labor, Equipment, Sub, and Other, etc.

-

Copy Accounts Payable Material item to Labor, Equipment, Sub, and Other, etc.

-

Autolink Sage CM Tax Codes to SIC Tax Schedules (applicable only to SIC Tax Schedules)

-

Select Accounting Link > Posting Preferences > Tax Codes.

-

Select SIC Item or SIC Tax Schedules.

- Select Choose Bulk Action, choose a bulk action from the dropdown and select Apply Changes.

-

Select the edit icon on the right of a tax and apply the needed changes in the row.

The updates made in the grid are stored locally.

-

Select Save to update the system.