QuickBooks Online configuration

Below are some general guidelines on how to set up QuickBooks Online for a construction or engineering firm with the intention of integrating it with Sage Construction Management.

Import vendors and employees

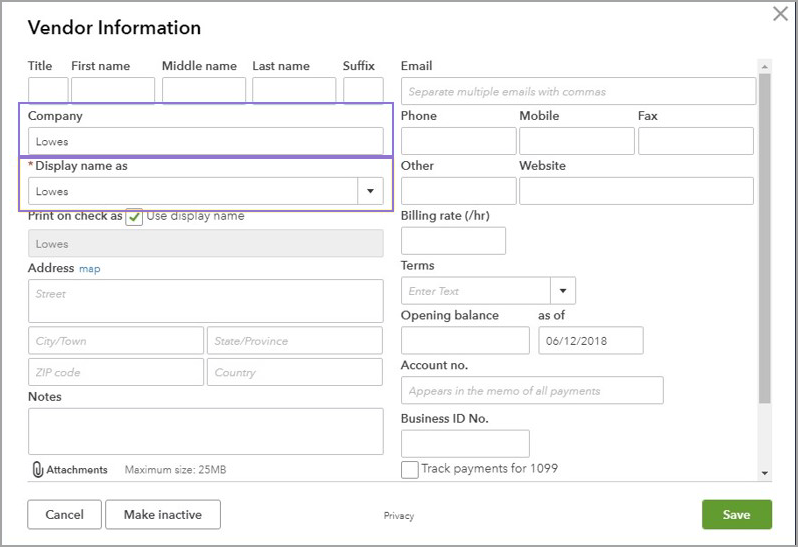

You can import active vendors and employees from QuickBooks Online using AccountingLink, so it's recommended to review each list in regards to their status. For example, if a vendor is no longer used, then it must be marked as inactive in QuickBooks Online before using AccountingLink to import them into Sage Construction Management.

Auto link customers and vendors with Sage Construction Management companies

When you automatically link records between Sage Construction Management and QuickBooks Online, the Company Name field in QuickBooks is used for matching. The customer or vendor name will not be used.

Sage Construction Management does not offer a Customer: Job import option and existing jobs must be completed in QuickBooks Online. However, newly awarded projects must be set up in Sage Construction Management and then exported to QuickBooks Online. The client referenced in the prime contract is the customer and the combination of the project and prime contract numbers is the job number in QuickBooks Online.

| Account type | Account description | Comment |

| Bank | Checking Account | |

| Accounts Receivable | Accounts Receivable | |

| Other Current Asset | Retentions/Holdback Receivable |

This account must be created if retainage or holdbacks for prime contract invoices will be tracked in the accounting system. |

| Accounts Payable | Accounts Payable | |

| Other Current Liability | Retentions/Holdback Payable | This account must be created if retainage or holdbacks for sub invoices will be tracked in the accounting system. |

| Sales Tax Payable | There might be multiple sales tax payable accounts, such as one for each region in Canada (GST, PST, HST) or for each sales tax authority in the United States. | |

| Credit Card | Credit Card Name (AMEX, VISA, MC, and so on) | There might be multiple credit card payable accounts, one for each card type. |

| Income | Construction Income | Cost code service items will reference this account when exporting prime contract invoices. |

| Expense or Cost of Goods Sold (COGS ) | Construction Expense | Cost code service items will reference this account when exporting bills, sub invoices, and employee miscellaneous expenses. Alternatively, you can use separate expense accounts for each resource type, such as materials, labor, equipment, sub, and other. |

The core principle of job costing is to maintain a primary list of cost codes to categorize work consistently. These standard cost codes will be used across estimating, project management, and accounting teams to ensure smooth and accurate information flow between departments.

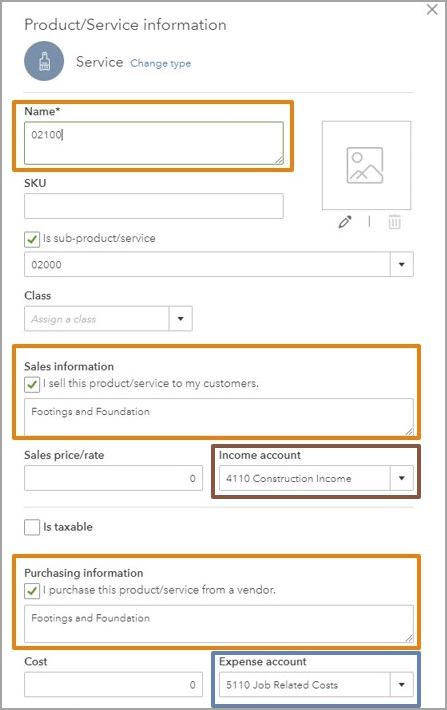

To support integration between Sage Construction Management and QuickBooks Online, enter each cost code as a service item, matching both the code and description in both systems. These service items must reference the same expense/COGs and income GL accounts. When exporting project financials from Sage Construction Management to QuickBooks Online, job cost code references are automatically replaced with their corresponding service items, so consistent naming and account mapping are essential.

Finally, configure the AccountingLink Sync Preferences, to control how these items are mapped and synchronized during the export process.

Learn more about importing CSI or NAHB codes into QuickBooks Online.

Service items in QuickBooks Online do not need to have a resource identifier, such as material, labor, equipment, sub, or other. As illustrated in the example below, the cost code 02000 or 03000 alone might be sufficient when construction-related expenses and income are categorized by type of work.

For example:

-

02000 Sitework

- 02000-M Sitework Materials

- 02000-L Sitework Labor

- 02000-E Sitework Equipment

- 02000-S Sitework Sub

-

03000 Concrete

- 03000-M Concrete Materials

- 03000-L Concrete Labor

- 03000-E Concrete Equipment

- 03000-S Concrete Sub

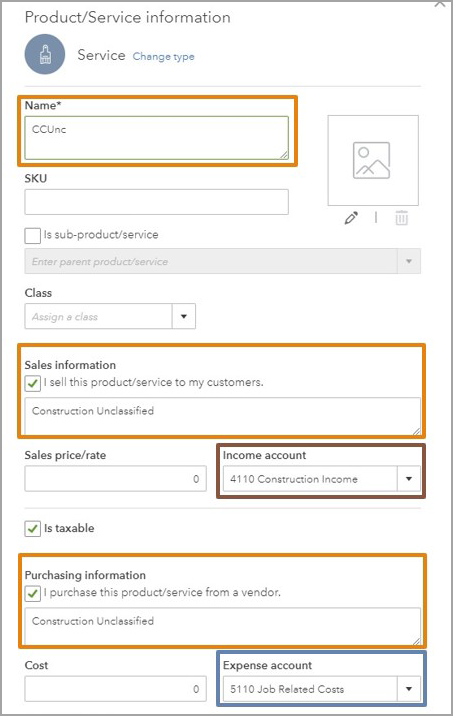

If Sage Construction Management and QuickBooks Online use a primary cost code structure, the AccountingLink must include a backup item for cases where a Sage Construction Management project cost code does not exist in QuickBooks Online. The unclassified item will reference the same expense/COGs and income GL chart of accounts as standard cost code service items.

The construction unclassified or backup item must be set as the default item for AP, AR, and time tracking in the Sync Preferences.

Because the QuickBooks Online Bills feature does not support tax codes, Sage Construction Management adds a separate line item to represent tax, ensuring the total amount matches in both systems.

Item name: AP Sales Tax: AP Sales Tax

AP account reference: Construction Expense

AR account reference: Not Applicable

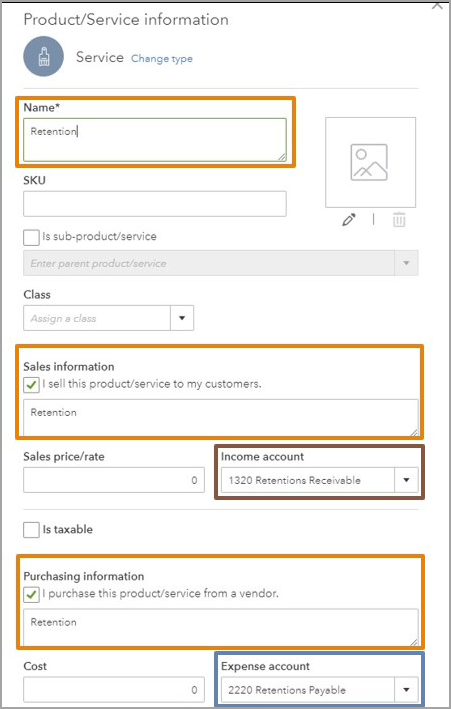

This option is applicable if retainage or holdbacks for sub invoices and prime contract invoices will be tracked in QuickBooks.

Learn more about tracking retainage in QuickBooks Online.

Classes are supported in AccountingLink for QuickBooks Online and can be used to categorize transaction details. If this feature is enabled in QuickBooks Online and used with Sage Construction Management, class records must either represent a resource (materials, labor, equipment, subcontractors, or other) or align with a specific Sage Construction Management project classification system.

You can find the classification settings for Sage Construction Management in Settings > Feature Settings > Lead / Project.

Learn more about the class linking options for Accounts Payable transactions and for Accounts Receivable transactions.

To enable classes in QuickBooks Online, do the following:

- Go to Settings > Account and settings > Advanced > Categories.

- Set Track Classes to On.

- In the Assign Classes, select One to each row in transaction.

- Optionally, set Track Locations to Off.

- Optionally, do the following:

- Go to Settings > Account and settings > Advanced > Projects.

- Set Organize all job-related activity in one place to Off.

To help prevent duplicate invoice numbers when syncing with QuickBooks Online, do the following:

- Go to Settings > Account and settings > Sales.

- In the Sales form content section, set Custom transaction numbers to On.

To help prevent duplicate bill numbers when syncing with QuickBooks Online, do the following:

- Go to Settings > Account and settings > Advanced.

- In the Other preferences section, set Warn me if I enter a bill number that already been used for that vendor to On.